The process of taking a pharmaceutical drug through its drug discovery pathway can be challenging, time consuming, and expensive. It’s why more and more leading biotech and pharma companies choose to outsource clinical research work to contract research organisations (CROs) instead.

As a sponsor of a clinical trial, not only do you need to manage costs, but there’s huge pressure to keep expenses low.

This blog will give you a clear overview of why bringing a drug to market is so expensive and how adapting a new ‘agile way of working’ through an outsourced CRO can reduce costs without compromising on quality.

Given the wide range of medicines, devices and interventions studied across the world, it can be difficult to predict how much trials cost, however a recent study by the London School of Economics published in the Journal of American Medical Association (JAMA) has calculated that the average cost of bringing a new drug to market ranges from $314 million – $2.8 billion.

Trends in capitalised pre-human, clinical and total cost per approved new drug

There are a number of factors that contribute heavily to a trial cost:

In addition to these factors each operational phase and the transition between each phase presents its own set of challenges which impact a trial’s expenses.

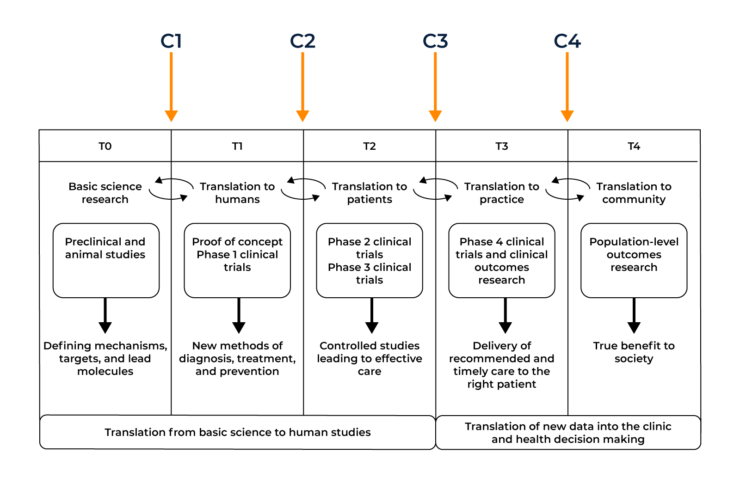

In order to maximise the number of novel and efficacious treatments available for patients at their ‘bedside’, several translational models have been created to visualise and streamline the process of getting drugs into a clinical setting.

The diagram below shows the operational phases of the translational model and the chasms between them. T0-T4 shows the translational phases required for drug development, C1-C4 shows the chasms between the phases that need to be overcome for successful drug approval.

In order for this first chasm to be crossed, the basic science discoveries uncovered in the lab environment must first have the potential to have a useful application. Many basic science discoveries help to form a clearer picture of how diseases work but may not have a direct application in terms of translation into the clinic. If a compound is deemed a suitable candidate it must undergo in vitro studies (testing in a test tube, culture dish, or elsewhere outside a living organism) and in vivo studies (in a living organism) studies to begin bridging the C1 gap into a proposed human application.

Arguably the biggest obstacle to be overcome in the first translational chasm is the lack of communication between different parties of the ‘translational continuum’. A researcher’s primary motivation is to uncover novel treatment targets whilst a pharmaceutical company must take into account both patient care and the financial burden of clinical trials. These different groups belong to diverse bodies, follow separate implicit or explicit rules, and respond to different sets of motivations or implementation criteria. Clinician scientists are rarely involved in the basic science experiments and are unable to uncover novel targets themselves. There is a clear need for both parties to unite with each other and improve the communication gap in order to optimise the T-0 to T-1 translation.

As a result of this gap, many candidates fall by the wayside at this point. Companies have more than likely already invested heavily before they get to human studies. Only promising candidates get taken to the next step and only after successful ‘bench’ data becomes available. This is a very costly aspect for companies as there are specific data sets required to ensure the regulators accept moving to human trials. It’s hugely important that companies invest in a strong regulatory strategy (an aspect CROs can help with) to support their drug development programme.

Once in vitro and in vivo work have undergone successful completion, the transition from animal tests to testing the effects on patients can begin. In order for a drug to become available for public use and deemed ‘safe’, it must undertake three phases of clinical trials:

Typically the second translational chasm stems from poor clinical trial design. As clinical study design improves, the risk of various trial biases have been decreasing, leading to more promising and accurate results.

Further problems with the second chasm involve the poor success rate of drugs making it into the clinic. It can cost billions for pharmaceutical companies to discover, develop, test and seek the eventual drug approval by the relevant health authority.

The translation from T0-T3 is also highly inefficient with typically thousands of potential drug molecules being cut down to one successful compound. This chasm is being tackled by new clinical trial designs hoping to improve the translation from animal to clinical application.

Before even reaching this Translational Chasm, some biotech companies fail to get past the in vitro/in vivo stage as they cannot raise enough funds to progress. This, coupled with the financial implication of the C2 chasm can be a particularly expensive endeavour.

Inadequate trial design and a regulatory strategy that hasn’t been thought through properly can add to the high cost of clinical trials.

The third translational chasm involves the transition of a successful drug from its trial phases into routine clinical practice. This is typically initiated by the drug becoming licensed before implementation into standard practice.

The major flaw present in the third chasm comprises the poor implementation of clinical evidence. Many approved drugs can be used to treat several diseases other than the initial disease they aimed to treat, however this does not tend to come to light until the publishing of post marketing epidemiological studies. An example of this is the BCG vaccine (originally used to prevent the contraction of Tuberculosis) proving to be an effective treatment for bladder cancer.

A second example is the re birth of Thalidomide (a drug to treat morning sickness but was recalled due to teratogenicity) which has shown to be an effective treatment for skin and blood cancers. CROs play a critical role at this point, helping to deliver studies with new indications, bioequivalence studies, biosimilar studies in the most cost-efficient way. As a result of this chasm, clinicians are often unaware of the fact that such evidence can be generated and may not prescribe the most effective treatments for a particular disease until this has been proven in a clinical trial.

One of the costliest aspects of the C3 chasm is primarily the cost of the drugs themselves.

A novel compound or drug that has been granted marketing authorisation is usually patented by the Sponsor who ran the clinical trials. For a period, these drugs can be charged at a premium for the Sponsor to recover the cost of drug development and to generate a profit, however over time, bioequivalence studies, cheaper manufacturing methods and the expiry of drug patents can lead to the creation of generic drugs. CROs often run many of the different trials required for Sponsors to retain patent longevity by changing the drug indications in different demographics, re-formulation to improve them, or change drug delivery methods for faster absorption or ease of administration.

The final translational chasm sits between an approved drug and its acceptance into the public healthcare system. C4 takes a step back and takes a look at the overview of a drug’s impact on healthcare as a whole. Research into wider outcomes include public health surveillance of disease incidence, morbidity and mortality, and health-related quality of life indicators in populations defined by geographic and demographic categories.

When looking at disease treatments, one of the most common reasons for falling into the fourth chasm is its cost. This is particularly evident when looking at some immunotherapeutic therapies, which can cost in excess of £100,000 per year per patient with little increased benefit compared to existing, cheaper treatments.

Bioinformatics may play a larger role in minimising the size of this final chasm as the processing of big data sets is allowing for better health surveillance. Population studies, coupled with an increased investment from governments can ease the transition of drugs into the public health sphere.

It is imperative companies are aware of the current market status and healthcare requirements when designing their studies. Health economic data and patient reported outcome measures are key to this and are fundamental to overcoming the C4 translational chasm. A regional CRO can assist Sponsors in this area.

It is important to note that the translational continuum is not necessarily chronologically linear as shown earlier. Aspects of each operational phase can feed into each other both forwards and backwards. For instance, public epidemiological examination in T-4 may help to inform the need to look at a specific subset of drug targets in T-0. This is known as the reverse translational medicine axis– from bedside to bench.

It’s the feedback loops between operational phases that make translational medicine so effective. In the coming years, the various groups that make up the translational continuum should continue to work on improving their cohesion and overcoming their respective translational chasms.

Effective translational medicine should build upon the three pillars of bench, bedside and community with the discovery of new, novel compounds by basic scientists, the implementation of these compounds by pharmaceutical companies/clinicians and the impact these drugs have by public healthcare authorities.

Due to the four key translational chasms, drug development can be an expensive endeavour. C1 expense relies on successful ‘bench’ data with a strong regulatory strategy and financial backing to push it through to its T-1 stage. C2 costs are also impacted by inefficient regulatory strategies coupled with incorrect investment priorities and poor trial design. C3 financials are affected by the market itself, Sponsor competition, clinical development timelines and a constantly changing healthcare landscape. C4 cost implications become transparent if the final community pillar is not afforded proper due diligence. Without constant patient driven feedback, Sponsors would not be able to effectively improve their products or inform on future directions for their pipeline.

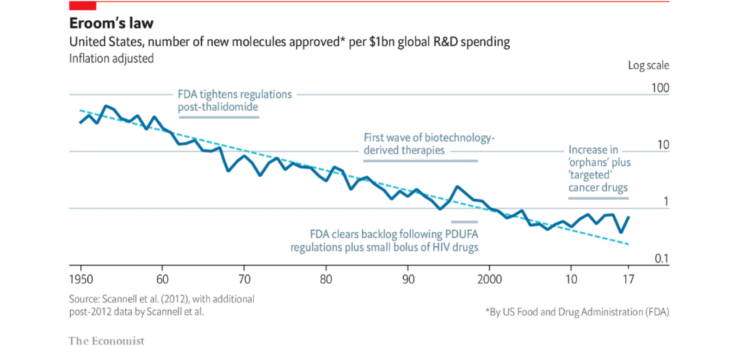

The phenomena of drug discovery progress becoming slower and more expensive over time is known as ‘Eroom’s law’. This is a barrier to progress for the pharmaceutical industry to bring new drugs to market quickly. Since 1950, the cost of drug development has doubled every nine years. When this is put into perspective, the same amount of money spent to create one successful drug today would have been enough to create 90 drugs in the 1950s.

So, what causes Eroom’s law?

This problem highlights the difficulty of new drugs often only being marginally better than those already on the market.

This problem is phrased as “better than the Beatles” to highlight the fact that it would be difficult to come up with new songs if all the new songs created had to be more successful than the Beatles.

The impact on trial cost

The treatment effects of a new drug versus an already effective drug will be much smaller when compared to the original treatment effects vs placebo. The smaller size of these treatment effects means an increase in clinical trial size is needed to show the same level of efficacy. Which means it costs more.

The progressive, increasingly stricter conditions around risk tolerance by drug regulatory agencies compared to drugs developed in the past makes research and R&D both costlier and harder. After older drugs are removed from the market due to safety reasons, the bar on safety for new drugs is increased. The ‘cautious regulator’ problem links in with the ‘better than the Beatles’ problem, as regulators tend to be more tolerant of risks when there aren’t many good treatment options available. Put simply, the availability of safe and effective drugs to treat a given disease raises the regulatory bar for other drugs needing approval for the same disease.

The impact on trial cost

Whilst this may be a problem in the context of Eroom’s law (leading to a more costly R&D process), tough regulations are essential to ensure all drugs used (and approved) in clinical trials end up being safe and effective.

This is the tendency to add human resources and other resources to R&D, which has generally led to a rise in R&D spending in major companies, and for the industry overall. This has worked well for returns in the past 60 years, although it is widely known that there isn’t any real innovative process which leads to long pay-off periods and money wastage. Intense competition between marketed drugs (where being second or third to launch is often worth less than being first) gives R&D incentives for investing additional resources to be the first to launch. There may also be a bias in large companies to equate professional success with the size of its budget.

Investors and many senior executives think that a lot of costs can be cut from R&D without reducing output substantially. Whether this is correct remains to be seen, although if so, it may be the single strategy most likely to counteract Eroom’s Law in the short term.

Simply throwing money at a clinical trial doesn’t necessarily equate to better outcomes.

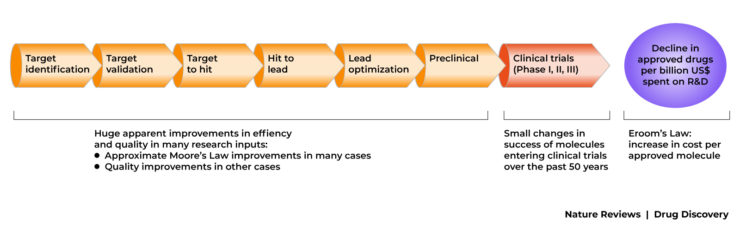

The ‘basic research–brute force’ bias is the tendency to overestimate the ability of advances in basic research (particularly in molecular biology) and brute force screening methods (embodied in the first few steps of the standard discovery and preclinical research process) to increase the probability that a molecule will be safe and effective in clinical trials.

The figure below shows the standard model of most drug R&D. It is, effectively, a serial search, filter and selection process. Scientific and technical advances have, superficially at least, increased the breadth of the funnel,(that is, more potential targets have been identified, and more drug-like molecules have been synthesised.

This is a necessary part of pre-clinical drug discovery, however more work is needed to make this process more efficient. As a general rule, it is much more cost efficient to rule out drug candidates at the pre-clinical stage before it enters the expensive clinical trial domain.

Some parts of the R&D process have improved, however overall efficiency has declined.

A CRO is a company that offers its clinical trial management services to pharmaceutical, biotech and medical device manufacturers. Some CROs will also run academic-led studies. The management of clinical studies often involves a lot more collaboration than most people think. Key parties including manufacturers, sponsors, ethical committees, competent authorities, hospitals, researchers, legal departments, participants and many more, are essential to the successful running of a trial.

The services that a CRO can offer varies depending on its size and the expertise of the individuals working there.

Typically a full service CRO will provide expertise in :

As clinical trials are the most expensive part of the Translational Model and with the ongoing trend of Eroom’s law – how can a CRO save on costs?

Company wide efficiency

Many large pharma CROs work in a ‘silo’ manner and departmental communication can break down and processes can end up being inefficient and costing the client more money. A CRO that can actively adapt to the fast-paced nature of clinical trials and rise to unforeseen challenges quickly is key to saving clients’ money.

PHARMExcel’s extensive experience in drug, device and combination studies across multiple therapeutic areas and trial stages ensures the delivery of its trials on time and within budget. We are a proven leader in delivering the following:

Project specific efficiency

Efficiency and quality control is underpinned across areas of the pharma projects we manage:

Challenging obstacles like Eroom’s law and the translational chasms can make clinical research both challenging and expensive.

With this in mind, clinical outsourcing to a specialist CRO like PHARMExcel can mitigate several of these challenges by addressing the factors that influence efficient deployment of the trial. It’s important for a Sponsor’s drug and regulatory strategy to select an experienced CRO based on specialism, staff experience and local knowledge, otherwise the cost benefit gained from outsourcing can be lost.

As a Sponsor you should evaluate whether an outsourced CRO can provide efficient trial design, transparent and accurate costings, centralised project management software and rigorous quality assurance practices.

"I have worked with other clinical trial research organisations on similar studies and PHARMExcel has been by far the most effective in achieving targets and the easiest to work with on a day to day basis."

Dr Kim Orchard, Senior Lecturer and Consultant Haematologist, University Hospital Southampton NHSFT.

If you’re looking for an experienced and dedicated CRO to deliver your clinical trial on target contact us today.

At PHARMExcel we specialise in an adaptive approach to successful clinical trial delivery, providing a flexible and innovative approach.

We offer in-depth knowledge and experience of the clinical research environment, particularly in the UK and Europe and have a network of regulatory, and other industry associates, allowing us to provide a global reach.

The company’s values: honesty, integrity, quality, teamwork and passion, are testament to the excellence and value PHARMExcel is able to deliver to its clients and partners.

Innovation in the pharmaceutical industry: New estimates of R&D costs | Elsevier Enhanced Reader

Translational research: understanding the continuum from bench to bedside – PubMed (nih.gov)

Diagnosing the decline in pharmaceutical R&D efficiency – PubMed (nih.gov)

Health economics: the cancer drugs cost conundrum (cancerresearchuk.org)

Diagnosing the decline in pharmaceutical R&D efficiency | Nature Reviews Drug Discovery